What is ESG

By: Harjinthar Singh PhD and Hafidz Win

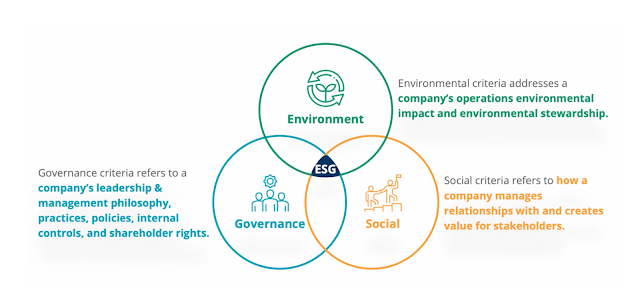

Environmental, Social, and Governance or ESG refers to a set of criteria used to evaluate the sustainability and ethical impact of an investment or business. Simply put, ESG is the convergence of these three issues to impact a company and its stakeholders. ESG factors are used to assess the performance of companies in terms of their environmental impact, social responsibility, and corporate governance practices through:

1. Environmental - This aspect of ESG focuses on a company’s environmental impact and its commitment to sustainability. It includes factors such as carbon emissions, energy efficiency, waste management, water usage, pollution prevention, and natural resource conservation. Companies that prioritise environmental sustainability may adopt practices like renewable energy usage, recycling programs, and eco-friendly manufacturing processes.

2. Social - The social dimension of ESG evaluates a company’s impact on society, including its treatment of employees, suppliers, customers, and communities. It encompasses issues such as labor rights, employee diversity and inclusion, human rights, community development, consumer protection, and product safety. Com- panies with strong social performance may prioritise fair labor practices, promote diversity and equality, engage in philanthropy, and support local communities.

3. Governance - Governance refers to the structures and processes through which a company is directed and controlled. It encompasses factors such as board composi- tion, executive compensation, shareholder rights, transparency, and ethical business practices. Good corporate governance ensures accountability, integrity, and responsi- ble decision-making within a company. This includes measures such as independent board oversight, transparent financial reporting, and effective risk management.

The concept of ESG has gained significant attention in recent years as investors and businesses recognise the importance of sustainability and responsible business practices. Many investors now consider ESG factors alongside financial performance when making investment decisions. Companies that prioritise ESG initiatives are often seen as more attractive to investors, as they are perceived to have a lower risk profile and a long-term focus.In addition, ESG considerations are increasingly seen as essential for long-term busi- ness success. Adopting sustainable practices can lead to cost savings, improved reputation, enhanced employee engagement, and reduced regulatory risks. It also demonstrates a company’s commitment to addressing global challenges such as climate change, social inequality, and ethical business conduct. ESG sustainability emphasises the integration of environmental, social, and governance factors into business strategies and investment decisions, with the aim of creating long-term value while also addressing societal and environmental challenges.

ESG impacts the entire landscape of a companies operations. Rather than values, ESG is about the ability to create and sustain long-term value in a rapidly changing world, and managing the risks and opportunities that are associated with these changes.

ESG Relevance in Making Financial Decisions

Environmental, Social, and Governance (ESG) factors have become increasingly relevant in the realm of financial decision-making. ESG considerations go beyond traditional financial metrics and focus on evaluating a company’s impact on the environment, its interactions with society, and the quality of its corporate governance. Integrating ESG considerations into financial decisions is aimed at fostering sustainable and responsible investing practices that align with broader societal and ethical goals:

-

Risk Management and Long-Term Performance - ESG factors can provide insights into potential risks that may not be captured by traditional financial analysis. Compa- nies that effectively manage environmental and social risks are often better positioned to weather challenges, such as regulatory changes, reputation damage, or supply chain disruptions. Evaluating a company’s governance practices can indicate how effectively it is managed and governed, which can impact its long-term performance and stability.

-

Competitive Advantage - Companies that prioritise ESG considerations may de- velop a competitive advantage by addressing emerging market trends, consumer preferences, and regulatory shifts related to sustainability and social responsibility. Investments in environmentally friendly technologies, innovative social programs, and ethical governance can enhance a company’s reputation and attract customers, investors, and talent.

-

Investor Demand and Fiduciary Duty - Increasingly, investors are seeking to align their portfolios with their personal values and societal concerns. Funds and asset managers that incorporate ESG criteria cater to this demand. Fiduciary duties of institutional investors and fund managers require them to consider all relevant factors that could impact investment performance. ESG factors are now recognised as material considerations.

-

Regulatory and Legal Factors - Regulatory changes and legal developments related to environmental and social issues can have financial implications for companies. Adapting to changing regulations can impact a company’s operations and profitabil- ity. Failing to meet certain environmental or social standards could result in legal penalties, reputational damage, or reduced market access.

-

Reputation and Brand Value - Companies with strong ESG performance are often seen as responsible corporate citizens. Positive reputation and brand value can lead to increased consumer loyalty, brand recognition, and market share. Conversely, companies with poor ESG performance may face consumer boycotts, negative media attention, and decreased investor interest.

-

Access to Capital - Companies that excel in ESG areas may find it easier to access capital as investors increasingly prioritise sustainable and responsible investments. Sustainable investment funds and indices often attract significant investor interest, potentially leading to higher stock prices for companies included in these portfolios.

-

Cost Savings and Efficiency - Sustainable practices, such as energy efficiency and waste reduction, can lead to cost savings over time. Companies that implement environmentally friendly practices may experience lower operational costs.

Integrating ESG factors into financial decisions involves thorough research, data analysis, and consideration of a company’s environmental, social, and governance practices. This can be achieved through ESG ratings, reports, and specialised ESG investment funds. As awareness of the impact of ESG factors grows, investors are recognising the importance of making financially sound decisions that also align with their values and contribute to a more sustainable and equitable world.

Key Environmental, Social, And Governance Issues

Environmental, Social, and Governance (ESG) issues encompass a wide range of topics that pertain to a company’s impact on the environment, its interactions with society, and the quality of its corporate governance. These issues are critical considerations for investors, stakeholders, and businesses aiming to promote sustainability, responsibility, and ethical practices. Key ESG issues within each category are:

-

Environmental Issues

-

Climate Change and Carbon Emissions - The impact of greenhouse gas emissions, the transition to renewable energy sources, and efforts to mitigate climate change risks.

-

Biodiversity and Ecosystems - Preservation of biodiversity, protection of natural habitats, and responsible management of ecosystems.

-

Resource Management - Sustainable use of natural resources, including water, minerals, and raw materials, to avoid depletion and environmental degradation.

-

Waste Management - Strategies to minimise waste, promote recycling, and reduce pollution, including plastic waste and hazardous materials.

-

AirandWaterPollution-Effortstoreduceairandwaterpollution,monitoremissions, and safeguard air and water quality.

-

Deforestation - Addressing the impact of deforestation on ecosystems, local commu- nities, and climate change.

-

-

Social Issues

-

Labor Practices - Fair wages, safe working conditions, and human rights protections for employees and workers throughout the supply chain.

-

Diversity and Inclusion - Promoting diversity in the workplace, ensuring equal opportunities, and combating discrimination based on gender, ethnicity, or other factors.

-

Employee Health and Well-being - Providing benefits, support, and resources for employee well-being, mental health, and work-life balance.

-

Community Engagement - Engaging with local communities, respecting their rights, and contributing to their development and well-being.

-

Product Safety and Quality - Ensuring the safety, quality, and ethical production of goods and services for consumers.

-

Human Rights - Upholding human rights standards and addressing issues such as child labor, forced labor, and unethical sourcing.

-

Governance Issues

-

Board Composition and Independence - Ensuring a diverse and independent board of directors that can effectively oversee company operations.

-

Executive Compensation - Aligning executive pay with company performance and long-term value creation.

-

Ethical Business Practices - Preventing corruption, bribery, and other unethical practices through transparent and accountable governance.

-

Shareholder Rights - Respecting the rights and interests of shareholders, including proxy voting and the right to influence key decisions.

-

Data Privacy and Security - Protecting customer and stakeholder data, ensuring privacy, and maintaining cybersecurity measures.

-

Risk Management - Effective management of risks, including financial, operational, and reputational risks, with clear communication to stakeholders.

-

Anti-Corruption and Transparency - Promoting a culture of integrity, compliance with anti-corruption laws, and transparent reporting of financial and non-financial information.

Addressing these key ESG issues requires a comprehensive approach that integrates sustainability into a company’s core values, strategies, and operations. Companies that effectively manage these issues can enhance their long-term resilience, reputation, and competitive advantage, while contributing to positive social and environmental outcomes.